Dominance of ShopeeFood and GrabFood in Vietnam’s Food Delivery Market

ShopeeFood and GrabFood have established a near-monopoly in Vietnam’s online food delivery sector, collectively capturing around 90% of the market. These figures are supported by two separate surveys conducted by reputable research firms, highlighting the competitive landscape and evolving dynamics within the industry.

Market Share Breakdown

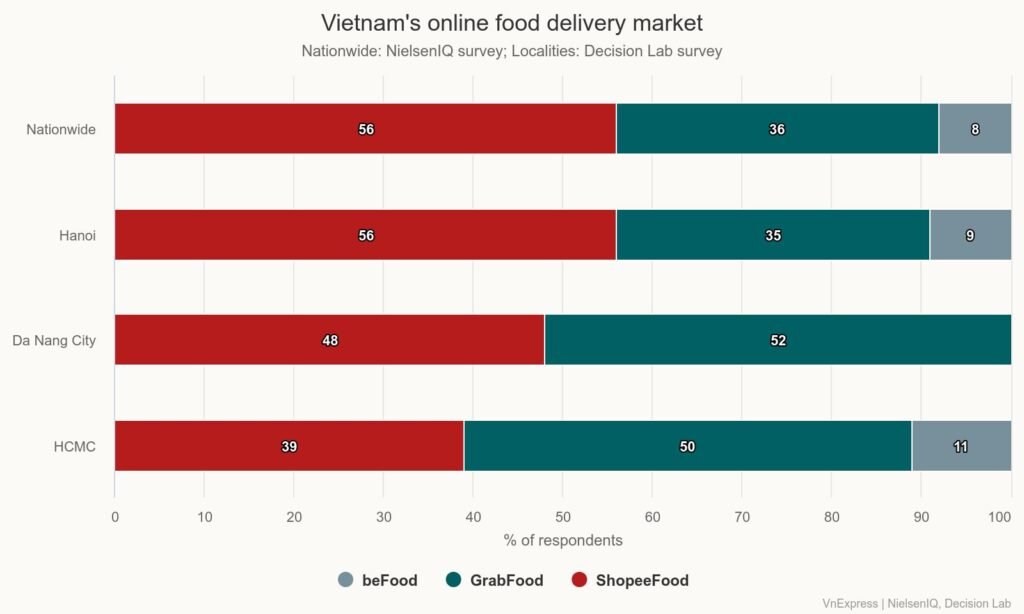

According to a survey by NielsenIQ, a U.S.-based market research company, ShopeeFood holds the largest share with 56%, followed closely by GrabFood at 36%. BeFood, operated by Be, ranks third. The data was collected from orders placed over a seven-day period during a consumer survey in April, offering a snapshot of user behavior across different platforms.

A similar study by Decision Lab, an online market research firm, confirmed these findings. The survey, conducted in Hanoi, Da Nang, and Ho Chi Minh City (HCMC), found that ShopeeFood and GrabFood together dominate approximately 90% of the market in Hanoi and HCMC. In Da Nang, their combined presence is nearly complete.

In Hanoi, ShopeeFood leads with a 56% market share, while GrabFood commands 50% in HCMC. Meanwhile, BeFood performs strongest in HCMC, securing an 11% market share compared to 9% in Hanoi. The Decision Lab survey involved interviews with around 1,000 consumers about food and drink orders placed via apps in the two days prior to the survey.

User Preferences and Demographics

The research also revealed distinct preferences among users of different platforms. ShopeeFood users tend to favor items such as milk tea, fast food, and snacks, while GrabFood customers prefer full meals, including rice, seafood, healthy foods, juices, and coffee. These trends align with age demographics: ShopeeFood is particularly popular among users aged 16–24, whereas GrabFood has a stronger following among those 35 and older.

Growth of the Food Delivery Sector

The Vietnamese food delivery market is experiencing rapid growth. According to the “e-Conomy 2024” report by Google, Temasek, and Bain & Company, the ride-hailing and food delivery market reached $4 billion last year, marking a 12% increase from 2023. Projections suggest it could grow to $9 billion by 2030.

Statista, a German data platform, estimates that the online food delivery market in Vietnam is valued at nearly $2.8 billion this year, with an annual growth rate of 9.34% through 2030. By the end of the decade, the market could reach $4.4 billion. This growth is driven by factors such as widespread smartphone adoption, busy lifestyles, and a growing preference for convenient dining options.

Intense Competition and Market Shifts

The food delivery market has seen intense competition over the past three years. In 2023, six platforms operated in the space: ShopeeFood, GrabFood, BeFood, GoFood, Baemin, and Loship. However, several players have since exited the market. Baemin ceased operations in Vietnam in December 2023, and Gojek left in September 2024, eliminating GoFood. Additionally, the local platform Loship also shut down late last year.

Despite this consolidation, the dominance of ShopeeFood and GrabFood may soon face new challenges with the entry of Xanh SM, a company linked to Vietnam’s richest man, Pham Nhat Vuong. Last month, Xanh SM launched its food delivery service, Xanh SM Ngon, featuring over 2,000 curated restaurants in Hanoi, with plans for nationwide expansion.

Innovation and Future Strategies

Both ShopeeFood and GrabFood are leveraging artificial intelligence (AI) to enhance restaurant partners’ sales through optimized marketing and innovative features. GrabFood offers group ordering, solo dining solutions, and in-store dining vouchers, while ShopeeFood employs AI for affiliate marketing and livestreams to stimulate demand.

Nguyen Hoai Anh, a representative from ShopeeFood, stated, “We will strengthen AI applications to better understand and assess users’ preferences, needs, and daily dining habits.” She added that the food delivery market presents both opportunities and challenges, requiring platforms to continuously innovate by expanding partnerships, optimizing technology, and improving customer experiences.