A Call for Collective Action on ESG in Nigeria

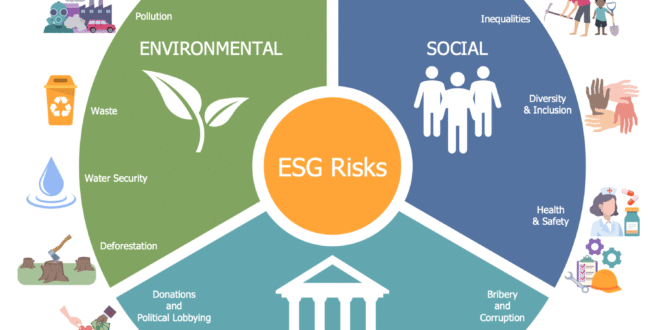

British American Tobacco Nigeria has emphasized the importance of integrating environmental, social, and governance (ESG) principles into the core of Nigeria’s industrial and economic growth. The company is encouraging leaders from both the public and private sectors to collaborate in making ESG a central pillar of national development.

At the Green Business Breakfast Meeting held at the John Randle Centre in Onikan, Lagos, Odiri Erewa-Meggison, Director of External Affairs at BAT West and Central Africa, highlighted the company’s long-term commitment to ESG as a call for collective action. She described this initiative as a step toward creating a future where profitability and purpose go hand in hand.

Erewa-Meggison stressed the need for urgent action against climate change through collaboration, shared responsibility, and long-term planning. She pointed out that BAT’s focus on sustainability is not just a corporate policy but a cultural imperative, aligned with the company’s vision of building “A Better Tomorrow.”

One key element of this vision is the ESG Forum, which BAT Nigeria co-convenes. This multi-sector platform has grown into one of Nigeria’s leading private-sector-led ESG advocacy groups over the past two years. Now in its third edition, the forum provides a space for stakeholders to bridge knowledge gaps, form meaningful partnerships, and drive measurable impact across industries.

Among the forum’s most significant achievements is the Young Professionals Fellowship (YPF), a six-month mentorship program that equips emerging talents with the skills needed to lead in the evolving ESG landscape. According to Erewa-Meggison, such initiatives are essential in addressing the talent gap Nigeria faces during its transition to a green economy.

BAT Nigeria has also demonstrated its deepening commitment to environmental and operational sustainability. The company has achieved zero-waste-to-landfill status at all its operational sites, implemented ongoing water recycling processes, and is on track to achieve 100% renewable electricity by 2030. Additionally, the company has maintained a strong workplace safety record, with zero lost-time incidents since 2021, proving that environmental integrity and employee well-being can coexist.

Erewa-Meggison praised the alignment between Lagos State’s climate strategy and BAT Nigeria’s ESG vision. She described the ESG Forum as a living laboratory where private innovation meets public ambition. BAT Nigeria is ready to collaborate on clean energy projects, ESG upskilling, and circular economy innovations that are inclusive and future-ready.

“This is no longer about ticking boxes. It’s about building an ecosystem where ESG becomes the foundation of competitive, responsible, and regenerative enterprise in Nigeria,” she added.

Titi Oshodi, Special Adviser to the Governor of Lagos State on Climate Change and Circular Economy, echoed Erewa-Meggison’s call for action. She commended BAT Nigeria and other corporate partners for moving beyond rhetoric to tangible action. Oshodi noted that Lagos is not just building a climate strategy but a green economy, supported by policies like the N14.815bn Green Bond and the 80 Million Clean Cookstove Project, which provide clean energy to underserved households while creating jobs and reducing emissions.

Dr. Tunde Lemo, Chairman of Lambeth Capital and former Deputy Governor of the Central Bank of Nigeria, further emphasized the financial value of sustainability in his keynote address titled “The Urgency of Now.” He argued that climate action is no longer just a moral obligation but also an economic opportunity. Lemo pointed out that carbon has now become an asset class, and Nigeria has the potential to earn billions annually from compliance-grade carbon credits through mechanisms like the Paris Agreement Crediting Mechanism.

He encouraged regulators and investors to prioritize projects aligned with the Paris Agreement Crediting Mechanism, linking Nigeria’s environmental policies to sovereign carbon markets. Lemo called on financial institutions to develop climate-specific investment tools and risk guarantees that would accelerate green entrepreneurship and infrastructure development.

Info Malang Raya Its All About World News

Info Malang Raya Its All About World News