The Future of AGOA and Its Impact on African Economies

At the 2024 African Growth and Opportunity Act (AGOA) Forum in Washington DC, Katherine Tai, then the US trade representative, shared her experience at the Made in Africa Exhibition near Soweto, South Africa. She described the wide range of products on display, from large drones to delicious food items, beautiful jewelry, and high-quality Peri Peri sauce. “I could see the pride the business owners have in their creations, and it was a powerful reminder of how AGOA impacts real people and real lives,” she said.

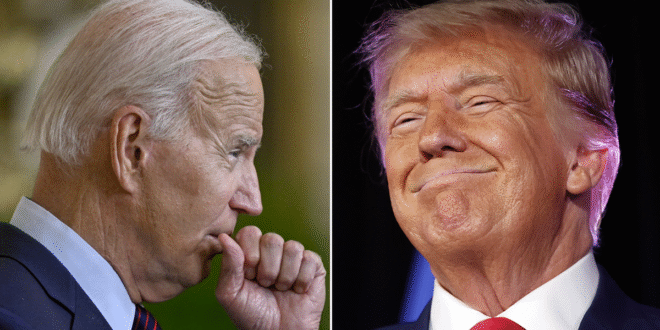

The African Growth and Opportunity Act, which has been central to US trade policy towards Africa since its approval by Congress in May 2000, provides tariff-free access to the US market for African manufacturers. It allows eligible African countries to export over 1,800 products duty-free to the US and has historically enjoyed bipartisan support in Congress. However, with Donald Trump now serving his second term as president, and his opposition to free trade becoming more pronounced, there are growing concerns about the future of AGOA.

How Effective Is AGOA?

Some analysts argue that the impact of AGOA on Africa’s external trade flows is overstated. According to a note from Capital Economics, total exports under AGOA amounted to just 0.5% of regional GDP in 2023. For the two countries most reliant on AGOA-facilitated trade, Nigeria and South Africa, exports to the US through the act were around 1% of GDP last year.

While Africa’s reliance on AGOA has decreased—only 33% of total exports to the US were shipped under AGOA last year compared to 81% in 2008—trade ties with the EU and China have strengthened. However, for industries that benefit from AGOA, such as the South African automotive industry or the apparel sector in several African nations, the end of the act could be devastating.

In 2023, clothing exports from Africa to the US totaled $1.2 billion, with over 96% benefiting from AGOA’s duty-free exemptions. Kenya led the way as the top apparel exporter under the program. The impact of losing AGOA benefits became evident when Ethiopia was removed due to alleged human rights violations during the Tigray conflict in 2022. This led to the closure of a manufacturing facility by PVH, one of the largest US apparel manufacturers, and other firms reportedly left the market. Local reports indicated that thousands of jobs, mostly held by women, were lost.

Economic Impacts and Supply Chain Effects

In South Africa, the potential repeal of AGOA could have a significant multiplier effect, according to Menzi Ndhlovu, senior country risk analyst at Signal Risk. While AGOA may not contribute significantly to GDP, the supply chain effects involving major employers and consumers in rural areas would be substantial.

Witney Schneidman, a non-resident senior fellow at Brookings, agrees that AGOA’s loss would be felt keenly in South Africa. “Through the export of autos and citrus, South Africa’s numbers outrank everyone else’s in non-petroleum products by a multiple of five. That’s a lot of jobs here in South Africa,” he said. He also highlighted the ripple effects across the region, including industries like leather seat manufacturing and wiring.

Uncertainty and Investment Concerns

The uncertainty surrounding AGOA, which last received a ten-year extension in 2015, is already affecting investment decisions. A 2023 survey by the United States Fashion Industry Association found that 60% of respondents said the temporary nature of AGOA had discouraged long-term investments and sourcing commitments in the region. Many companies are planning to cut sourcing from AGOA members if the act is not renewed by June 2024.

Another challenge is that many eligible countries are not fully utilizing AGOA. As part of its 2015 reauthorization, Congress required participating countries to develop and publish AGOA utilization strategies. However, only 19 out of 32 eligible nations have done so.

Will AGOA Be Renewed?

Despite these challenges, Schneidman notes that the administration has not yet made any substantial statements about AGOA’s future. “It’s instructive that Trump’s threat against South Africa revolved around aid, not tariffs,” he said. While Trump has supported programs that improve US business access to African markets, such as the Development Finance Corporation, Ndhlovu believes that Trump is likely against AGOA, given his past treatment of trade agreements like NAFTA.

For the first time, AGOA’s renewal is also being considered in light of the African Continental Free Trade Area (AfCFTA), a landmark agreement aimed at unifying African markets and boosting intra-African trade. Some analysts suggest that Washington should shift its focus toward building a new partnership centered around AfCFTA.

David Luke, professor at the London School of Economics, emphasizes that Africa retains leverage in its relationship with the US. “I don’t think it’s a one-way street. If South Africa is thrown out, I would expect some reaction from the African side,” he said. African countries could exploit their reserves of critical minerals, essential for the green transition, as a bargaining chip.

While AGOA may eventually pass into history, it is clear that the US cannot afford to ignore Africa. Whether AGOA survives or is replaced by other trade arrangements, solidarity among African nations will be crucial in securing a better position with the Trump administration. “I just hope the African countries can find solidarity among themselves to withstand this situation. They cannot go their individual ways. They need to speak with one voice and coordinate better,” Luke concluded.

Info Malang Raya Its All About World News

Info Malang Raya Its All About World News