A New Era for AI and Tech Giants

Nvidia has made history by becoming the first company to reach a market valuation of $4 trillion, marking a significant milestone in the growing confidence that artificial intelligence will reshape the global economy. This achievement highlights the increasing influence of AI in various industries and signals a shift in investor sentiment toward tech-driven innovation.

The stock market saw a dramatic rise in Nvidia’s value shortly after the opening bell, with shares reaching as high as $164.42. Although the stock later dipped slightly, it still maintained a valuation just below the $4 trillion mark. This surge reflects the strong belief among investors that AI is not just a passing trend but a fundamental force driving future economic growth.

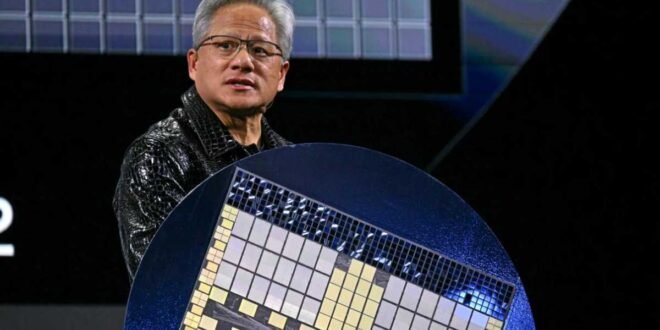

Steve Sosnick of Interactive Brokers emphasized the widespread conviction that AI is the future. “Nvidia is certainly the company most positioned to benefit from that gold rush,” he said. The company’s leadership under Jensen Huang, an electrical engineer, has been instrumental in positioning Nvidia at the forefront of this technological revolution.

Nvidia’s current market value surpasses the GDP of major economies such as France, Britain, and India. This achievement underscores the deep-seated confidence that AI will usher in a new era of robotics, automation, and advanced computing. As a leading chipmaker based in California, Nvidia’s performance has significantly contributed to the broader stock market’s recovery, outperforming major indices like the S&P 500 and the Dow Jones Industrial Average.

Part of this positive momentum stems from the relief that former President Donald Trump has scaled back some of his more aggressive tariff policies, which had previously caused turmoil in global markets. Although Trump has announced new tariff actions recently, U.S. stocks have remained resilient, with the Nasdaq hitting a record high on the same day.

Angelo Zino, a technology analyst at CFRA Research, noted that the market has largely avoided the worst-case scenarios related to tariffs. However, Nvidia still faces challenges, including U.S. export controls targeting China and ongoing trade uncertainties. Despite these hurdles, the company’s recent deal to build AI infrastructure in Saudi Arabia during Trump’s state visit in May highlighted potential opportunities within the president’s trade policy.

Technological Advancements and Market Challenges

Nvidia’s journey to a $4 trillion valuation has been marked by consistent growth over the past two years, driven by rising enthusiasm for AI. In 2025 alone, the company’s shares have climbed over 21 percent, far outpacing the Nasdaq’s 6.7 percent gain. This success can be attributed to a series of groundbreaking innovations, particularly in graphics processing units (GPUs), which are essential components in many generative AI applications, including autonomous vehicles, robotics, and other cutting-edge technologies.

The company has also introduced its next-generation Blackwell technology, which enhances supercomputing capabilities. One of its notable advancements is “real-time digital twins,” a technology that significantly accelerates production development across industries such as manufacturing and aerospace.

However, Nvidia’s dominance was briefly challenged in early 2025 when DeepSeek, a Chinese startup, introduced a low-cost, high-performance AI model that disrupted the traditional hierarchy dominated by companies like OpenAI. This development led to a sharp decline in Nvidia’s market value, with a loss of approximately $600 billion in a single trading session.

Despite this setback, Huang has expressed openness to DeepSeek’s contributions while advocating against restrictive export controls. This balanced approach reflects the complex interplay between innovation, competition, and regulatory challenges in the AI sector.

The AI Race and Future Prospects

In the most recent quarter, Nvidia reported earnings of nearly $19 billion, despite a $4.5 billion impact from U.S. export restrictions limiting sales to China. These results highlight the resilience of the company and the continued strength of demand for AI technologies.

Major tech firms, including Microsoft, Google, Amazon, and Meta, are actively competing in the multi-billion-dollar AI race. According to a recent UBS survey of technology executives, Nvidia has widened its lead over competitors, reinforcing its position as a key player in the AI ecosystem.

Zino noted that Nvidia’s recent surge reflects a deeper understanding of DeepSeek’s role in the AI landscape. While DeepSeek has stimulated investment in complex reasoning models, it has not posed a significant threat to Nvidia’s business. The company remains at the forefront of “AI agents,” a current focus in generative AI that enables machines to reason and infer more effectively than ever before.

“Overall, the demand landscape has improved for 2026 for these more complex reasoning models,” Zino said. This suggests that the AI industry is poised for continued growth, albeit with challenges ahead.

Disruption and the Future of Work

As AI continues to advance rapidly, it is also expected to bring about significant disruption. Executives from major corporations such as Ford, JPMorgan Chase, and Amazon have begun to openly acknowledge the potential for job losses in white-collar sectors due to AI automation. This shift in public discourse marks a turning point in how society perceives the impact of AI on employment.

Nvidia’s stock closed the day at $162.88, reflecting a 1.8 percent increase. While the company narrowly missed the $4 trillion valuation mark, its performance underscores the enduring confidence in its ability to drive the next wave of technological innovation.

Info Malang Raya Its All About World News

Info Malang Raya Its All About World News